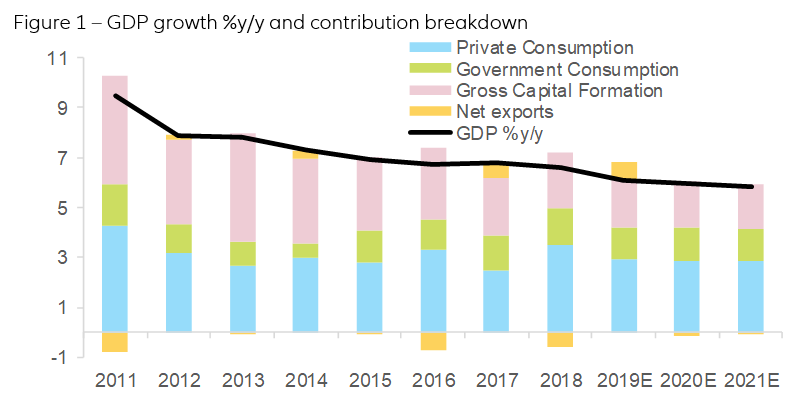

China’s GDP growth came in unchanged at +6.0% y/y in Q4 2019, in line with consensus expectations. This brings growth for 2019 at +6.1% (see Figure 1), which meets the lower end of authorities’ target of “between 6.0%-6.5%”.

Monthly data suggest some stabilisation at the end of 2019, with activity surprising positively in December. Industrial production growth increased to 6.9% y/y after an already strong rise in November (at 6.2%). This is above the average for 2019 (at 5.7%) and 2018 (at 6.2%). The growth in output in December was driven by an improvement in manufacturing (particularly auto and technology). Manufacturing also supported fixed asset investment, which grew by 5.4% y/y over January-December (compared with 5.2% over January-November). Conversely, investment in infrastructure and real estate slowed. Soft land sales suggest that housing construction might continue slowing in the coming months. On the consumer side, nominal retail sales growth held steady in December to 8.0% y/y. This suggests stable growth in real terms as well (inflation was unchanged), but average household real income slowed in Q4.

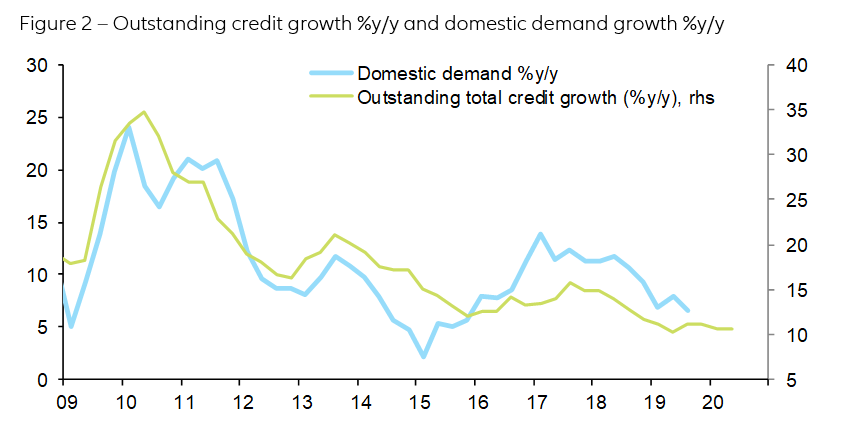

Looking forward, although the worst of the deterioration should be behind us, we don’t think the slowdown of the Chinese economy is over. Leading indicators have improved in recent months but remain at relatively low levels. The Phase One deal with the U.S. helps in removing some downside risk, but high tariffs remain in place and still soft global growth will put a lid on the revovery of China’s external activity. Credit data (see Figure 2), especially in the private sector, are not rebounding enough to help the recent uptick in domestic activity growth to turn into a self-sustainable recovery.

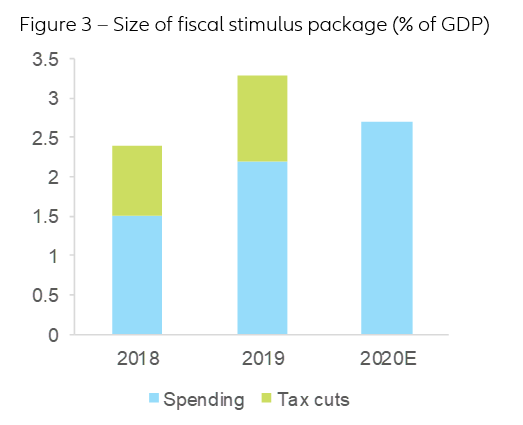

Policy easing remains prudent, as we think that authorities aim to manage the slowdown, not reverse it. The main obstacles to a more aggressive stance are the high debt level, and issues on the transmission of monetary policy. This year we expect 100bp worth of additional cuts in the Reserve Requirement Ratios (i.e. 150bp in total in 2020) and 30bp worth of cuts in the Loan Prime Rate. On the fiscal side, we expect stimulus amounting to 2.7% of GDP (vs. 3.3% in 2019, see Figure 3).

We expect China’s GDP growth at +5.9% in 2020 and +5.8% in 2021, after +6.1% in 2019. The official target for 2020 will be made public during the “Two Sessions” meetings in early March. It is likely to be set at “around 6.0%”. We expect another year of rising insolvencies in 2020 (+10%), given the continued economic slowdown and limited easing in financial conditions. The CNY should depreciate slightly against the USD over 2020 (c.0.80%), with intra-year volatility driven by news on the U.S.-China relationship.