Global business insolvencies are set to increase by +6% in 2020

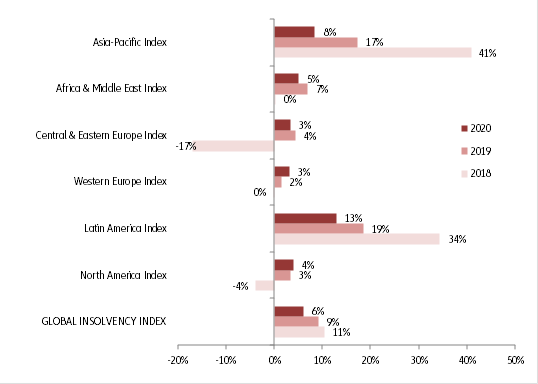

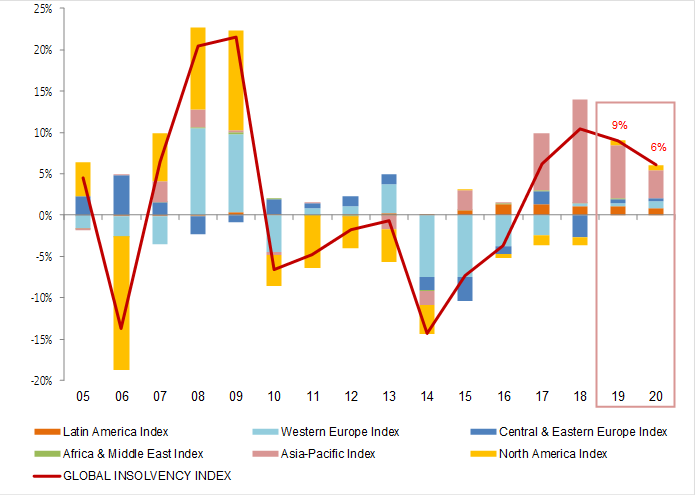

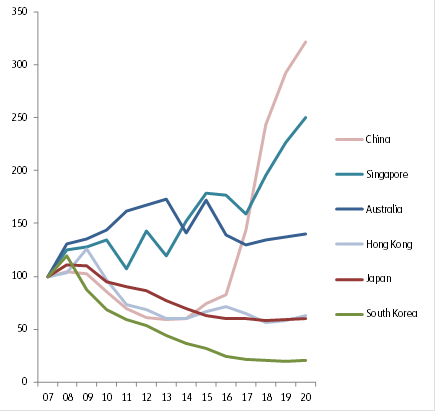

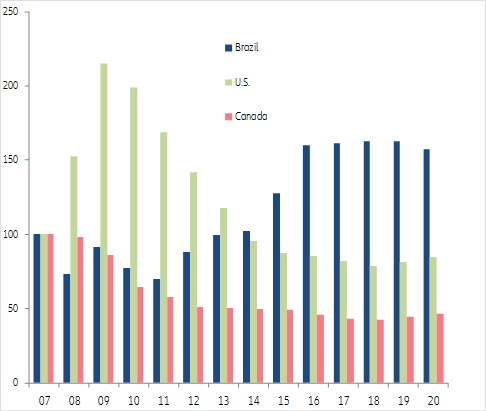

In 2019, global insolvencies rose for the third consecutive year. Indeed, our Global Insolvency Index, which covers 44 countries that account for 87% of global GDP, is expected to record a +9% y/y increase for 2019. This outcome reflects a prolonged surge in China (+20%) and, to a lesser extent, a trend reversal in Western Europe (+2%) and North America (+3%); it also reflects a slightly worse than expected trend compared to our previous forecast released in September (+8%), due to a more elevated number of insolvencies in specific countries such as Chile, Colombia, India, Russia and Singapore.

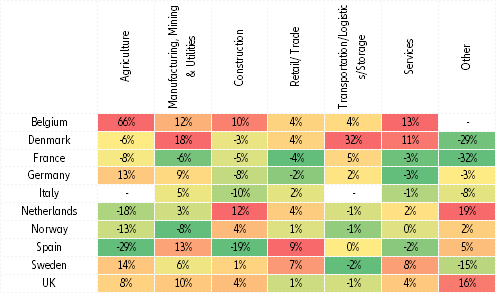

Indeed, 2019 has been marked by at least two key factors which contributed to this outcome: first the softer macroeconomic tempo; secondly the higher level of uncertainties due to both political issues and trade disputes. All in all, corporates not only faced weaker global demand, but also weaker global trade, notably in goods and in value terms, which led to weaker global manufacturing and increased price competition, on top of inventory issues due to preventive stockpiling (for example, the Brexit case) or oversupply (i.e. in the automotive sector). The implementation of new types of insolvency procedures and the cleaning of business registers through the official insolvency procedures in a few countries also explains the overall increase in insolvency figures.

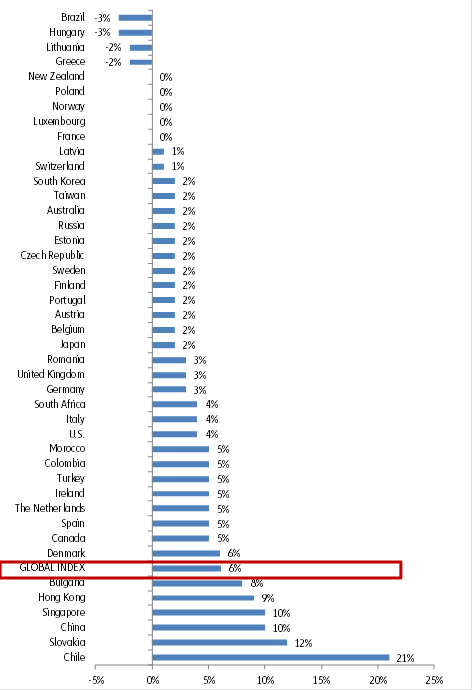

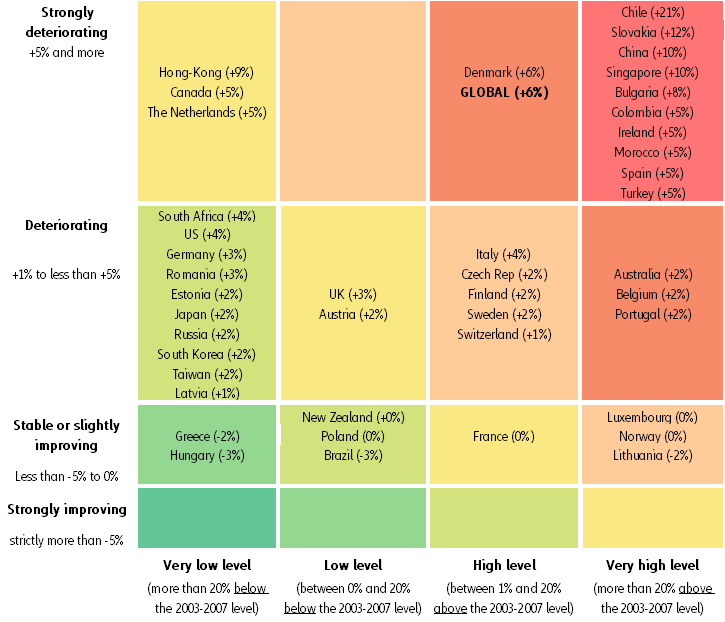

In this context, the upside trend proved to be broad-based, with insolvencies on the rise across all regions and across a majority of countries, both emerging and developed ones. Based on the latest infra annual data available per country, we expect 29 countries of our sample (i.e. 66%) to end 2019 with more insolvencies than in 2018.

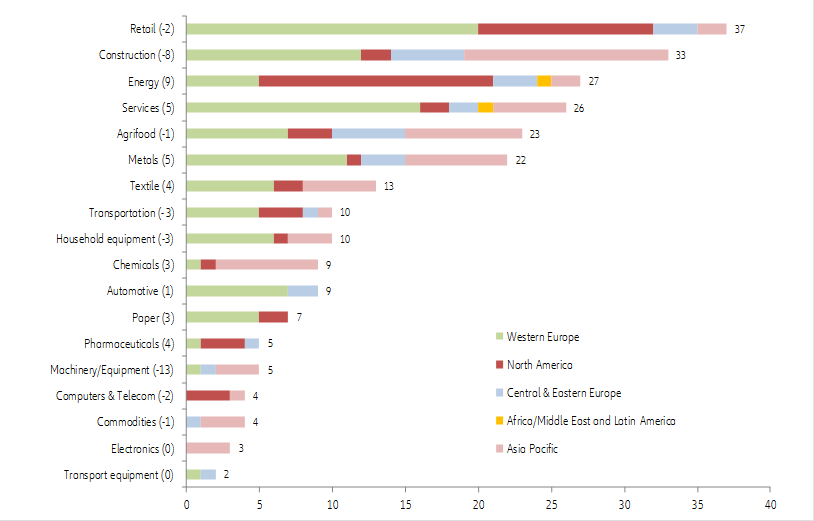

The risk of major insolvencies also remains high. Indeed, the first three quarters of 2O19 pointed to another batch of 249 insolvencies of major companies – namely those with over EUR50mn of turnover. This represents a relatively stable number of cases compared to the same period of 2018 (+1) but still a worsening severity in terms of cumulative turnover (+ EUR39.1bn to EUR145.2bn), which could have serious domino effects on providers along supply chains. In this regard, retail (with 37 major insolvencies over Q1-Q3), construction (33) and services (27) were the most concerned sectors in 2019, and Western Europe (104), Asia (64) and North America (51) the most impacted regions (For more details).

For 2020, we expect another increase in insolvencies, the fourth consecutive year of a rising trend, albeit at the slowest pace since 2016 (+6%). This outlook reflects a set of challenges that companies will face in 2020 on top of their business-as-usual issues: (i) a moderate pace of economic growth, with key economies, notably the advanced ones, to record below potential GDP growth, which has historically proved to be necessary to stabilize the level of insolvencies (+1.7% for Western Europe); (ii) the lagging effects of trade disputes, notably weaker trade, rise in input costs and supply-chain switches creating winners and losers; (iii) the lagging effects of political uncertainties and social tensions, notably in terms of inventory issues and loss of business and (iv) a prolonged discrepancy between manufacturing sectors, which are more exposed to international trade issues, and services sectors, which are benefiting from the resilience of domestic demand.

In other words, we expect softer demand to increase the vulnerability of companies with high fixed costs and firms with larger inventories or working capital requirement issues, while tougher price competition and an increase in production costs, notably wages, will limit margins and translate into additional woes for many companies. At the same time, we expect monetary policies to keep on being supportive in 2020, by contributing to a more sustainable debt financing in the short run; they will help to reduce the rise in insolvencies in 2020 but they won’t stop it and, on the contrary, they will increase liquidity risks on a more medium-term perspective.

In 2020, we expect four out of five countries to register an increase (compared to 2 out of 3 in 2019) in insolvencies. We also expect one out of two countries to record more insolvencies than registered on average over the 2003-2007 period, prior to the financial crisis of 2008. Countries which exhibited dynamic business creation over the past years would face an extra volume of insolvencies due to the number of young companies too weak to survive.

All in all, this insolvency outlook calls for more selectivity and preventive credit-management actions. It calls also for a close monitoring of trade disputes and other political and policy-related risks which will create a high level of volatility all along 2020.