U.S. retaliatory tariffs on EU imports (WTO ruling on Airbus subsidies): France and Italy to be most impacted

- The World Trade Organization (WTO) authorized on October 2nd the U.S. to impose tariffs on EU imported goods to cover an estimated annual loss of USD7.5bn in compensation for illegal state aid provided to aircraft maker Airbus SE. The ruling marks the resolution of a 15-year dispute over the EU’s subsidies for Airbus.

- The U.S. published a list of close to 100 products that will be taxed more starting from October 18th.

- We have calculated that in total EUR37bn of EU goods are targeted, the equivalent of 8% of total EU exports to the U.S.[1]. The goods taxed are mainly aircrafts, agri-food, beverages, machinery, paper and textiles.

- Aircrafts will be taxed at 10% compared to 0% previously while the other products will be taxed at 25% compared to an average of close to 4%. However, as this represents around 1.5% of total US imports, the impact on the total US import tariff is deemed negligible (less than +0.1pp from the current 8%).

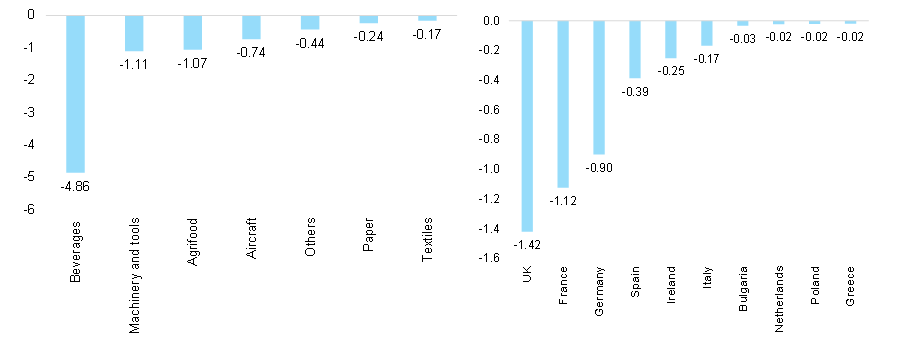

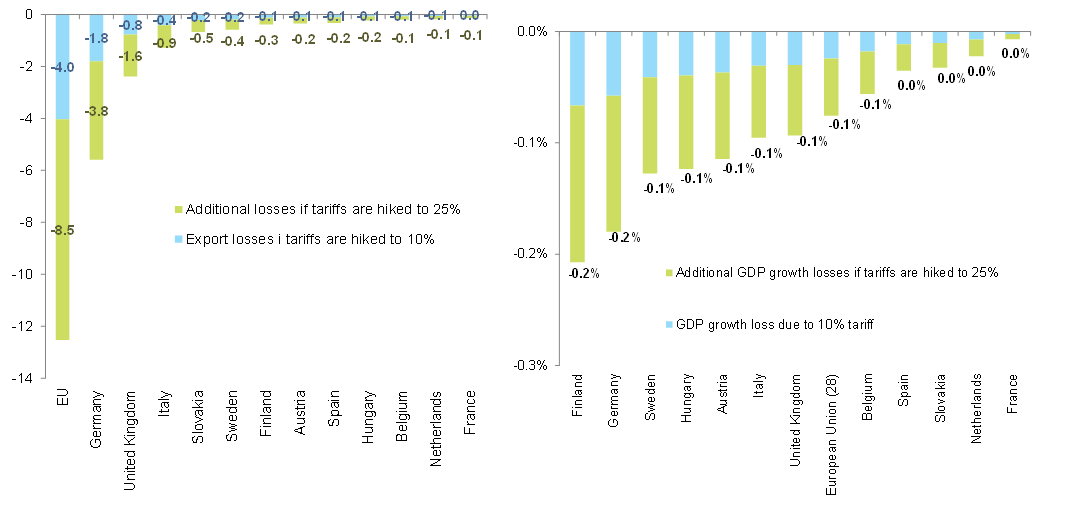

- We estimate the total impact on EU GDP growth at less than -0.1pp with an estimated global loss of annual exports of USD8.6bn. Looking at sectors, the biggest export losses will be registered in beverages (USD4.9bn) followed by machinery (USD1.1bn), agri-food (USD1.1bn) and aircraft (USD0.7bn). The top 5 most impacted countries are the UK (USD1.4bn), France (USD1.1bn), Germany (USD0.9bn), Spain (USD0.4bn) and Ireland (USD0.3bn). In GDP growth terms, this would mean around -0.1pp for the UK and less for the others.