Ten years ago, BMC Machines in Drunen learned the hard way.

BMC Machines talks about entrepreneurship and risks

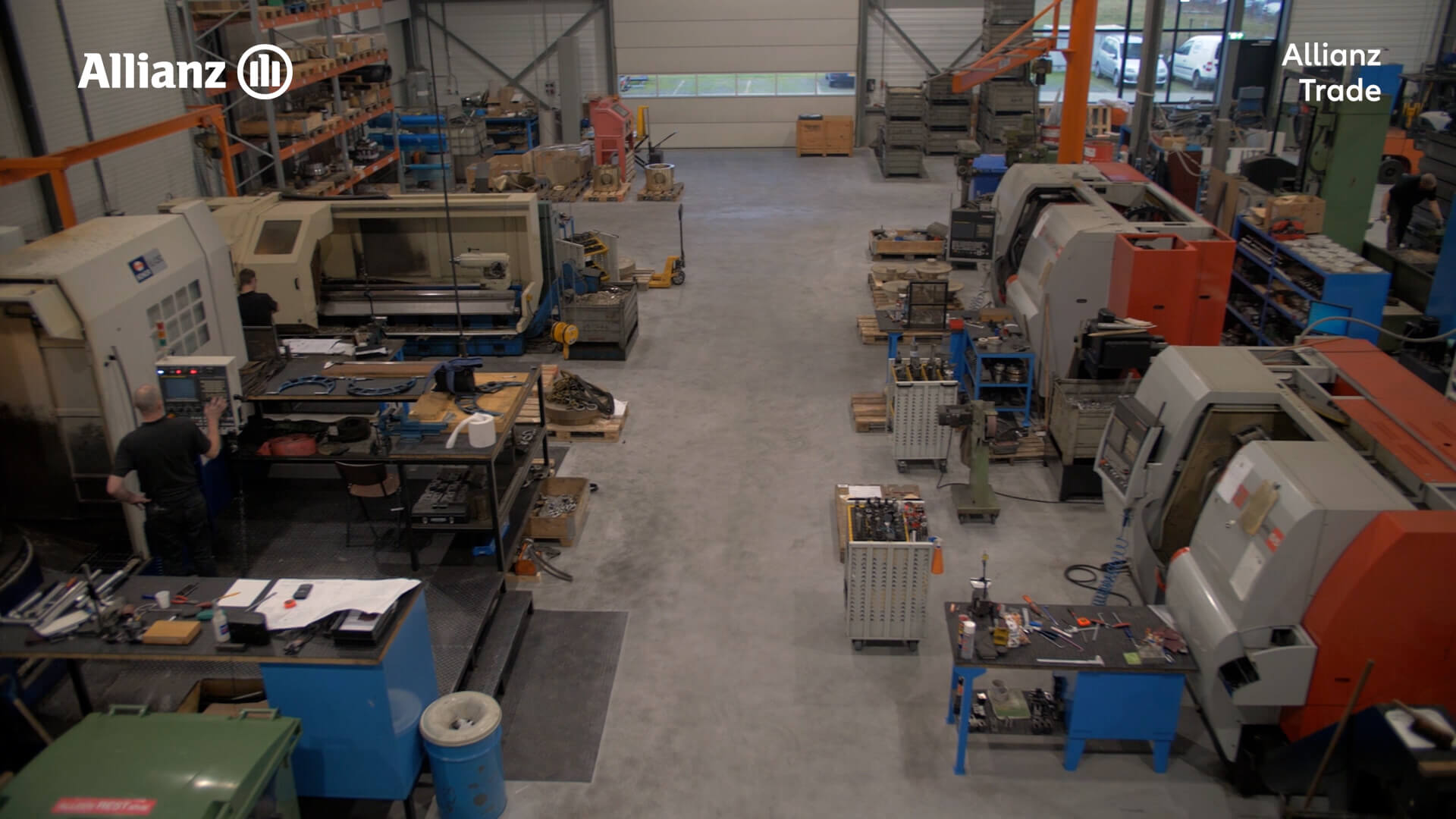

BMC Machines is a metalworking company that supplies high-quality semi-finished products to industries including shipbuilding, automotive, transportation, and oil. “About 60% is sent abroad.” Watch the video (in Dutch, click here for the French version) in which Kees van Bladel, co-owner of BMC, explains how his company handles payment risks. And how trade credit insurance can help with that.

Do you want to know more about how we can assist your company? Please contact us for more information or to schedule an appointment without obligation.

The turnover vanished as a result of bankruptcies

Until 2008, BMC Machines predominantly had regional customers. “The competition was fierce. Still, we performed well. With an excellent outlook. However, as businesses surrounding us collapsed, things began to deteriorate. We not only had to deal with unpaid invoices, but we also witnessed a disappearance of future turnover. We decided to change course. We entered the foreign market through unique casting products (such as ship propellers). Bigger customers, with better margins.”

Dare to make demands

We have also solidified our positioning. We have confidence in our abilities and are willing to assert our expectations. For example, strict payment terms. We used to make decisions on our own regarding doing business with a party, but now we make these decisions together with Allianz Trade. They check the customer and issue coverage. They also keep an eye on the customer. They keep us informed and warn us in time.”

“You no longer see the customer”

In today's digital era, such an approach is especially crucial. "In the past, it was common to have face-to-face interactions with customers, but now most of our interactions take place digitally. A request is received by email. We agree on a price, and then we proceed. You no longer have any idea about what is going on with the customer."

Kees Van Bladel stated, "It is very simple for us nowadays: either the customer pays in advance, or Allianz Trade carries out a check and issues a limit. There's no questioning it. If a customer does not agree to this, they will be dropped. I can tell you: it helps you sleep much better.”

Do you want to know how a trade credit insurance can help you?

A trade credit insurance helps you and your company. It provides peace and security for entrepreneurs. How? With a trade credit insurance, you know that your invoices will be paid.

Your company maintains financial health through well-organised accounts receivable management. And your cash flow is protected as well. With a customer check in advance, you know precisely which opportunities you can seize. And that works out well.