Deregulation has been firmly on Trump’s agenda, with a recent bill easing rules for banks by watering down prudential standards and undoing some elements of the so-called Dodd-Frank law. However, while greater financial liberalization can contribute to higher long term growth, it can also encourage greater risk taking. We outline the main changes brought about by the new legislation, assess who benefits the most and identify the main sources of risk related to this new era of financial deregulation.

Our main findings include:

- Regulatory burdens are set to lighten. For bank holding companies (BHCs) to be subjected to enhanced prudential standards (EPS), their asset threshold has now increased from 50bn to 250bn. There will be fewer requirements on custodial banks, who now don’t have to comply with supplementary leverage ratio (SLR) rules on funds placed with the Federal Reserve Bank (the Fed) or the European Central Bank (ECB). We estimate an increase in mortgage lending, with the bill introducing less stringent guidelines on what constitutes a “qualified mortgage”, while exempting loans of less than USD 400k from appraisal requirements. These changes are supported by an increasingly pro-business atmosphere in the Fed, with latest stress tests suggesting a lighter interpretation of regulatory laws.

- Small banking institutions are the big winners. We estimate that over USD 60bn per year of additional credit will flow into the US economy as a result of this new bill. In terms of market shares, this reflects a comeback to the pre-Dodd-Frank era. Importantly, small banking institutions are no longer exempt from the Volcker Rule, which means they are now free to make certain speculative investments.

- Less regulation, more risk. Risky activities have benefitted from deregulation, most visibly in the 27 y/y increase in the issuing of collateralized loan obligations (CLOs), accounting for more than USD 66bn. And while small banks are the big winners, they are taking on more risk, notably community banks aggressively expanding their commercial real estate activity. Due to the recent regulatory atmosphere, economic policy uncertainty indices reflect complacency in the financial sector. Where there is low regulation uncertainty, there is potential for bubbles to inflate, leading to severe crises.

Trump's wave of deregulation

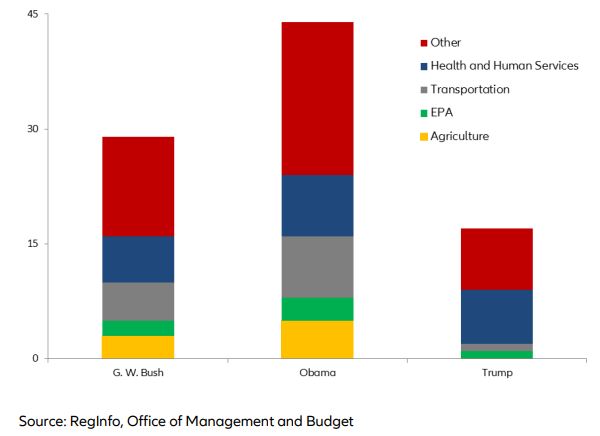

Since his election, President Trump has been determined to reduce the regulatory burden on the US economy. In 2017, the White House issued Executive Orders (EOs) directing federal agencies to repeal two regulations for every new regulation. On 23 May 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act was signed into law after a rare instance of bipartisanship in the US Congress. The bill aims to considerably reduce the regulatory burden on mid-size and smaller banks and BHCs. In the process, it undoes the so-called Dodd-Frank law, signed in the aftermath of the subprime crisis in order to put the US financial system on a stronger footing.

The bill specifically targets:

- the EPS, through provisions covering asset thresholds and stress tests;

- regulatory capital and liquidity requirements, including leverage and liquidity ratios;

- the Volcker rule;

- mortgage lending;

- consumer financial protection.

Figure 1: Published economically significant final rules within first year of a presidential term

-(2).jpeg)