We identify three forces weighing on the current world economic cycle causing higher growth without inflation

The IMF recently upwardly revised its forecasts with world growth expected at its highest since 2011.

Paradoxically, Christine Lagarde expressed a lot of reserves on the sustainability of this new regime of high growth, underlining the accumulation of debt, insufficient progress in terms of structural reforms and rising risks mainly related to overstretched financial markets.

Mirroring the interrogations of Janet Yellen on the absence of inflation, IMF’s contrasted outlook embodies a persistently high level of uncertainty on the characterization of the new world economic cycle.

We propose three tracks of interpretations allowing a precise identification of where we are in the cycle, in which way the fundamental nature of the cycle has changed and how to evaluate the solidity of this cycle.

The glass ceiling factor weighing on global economic cycle

The current level of synchronization in national cycles is exceptionally high.

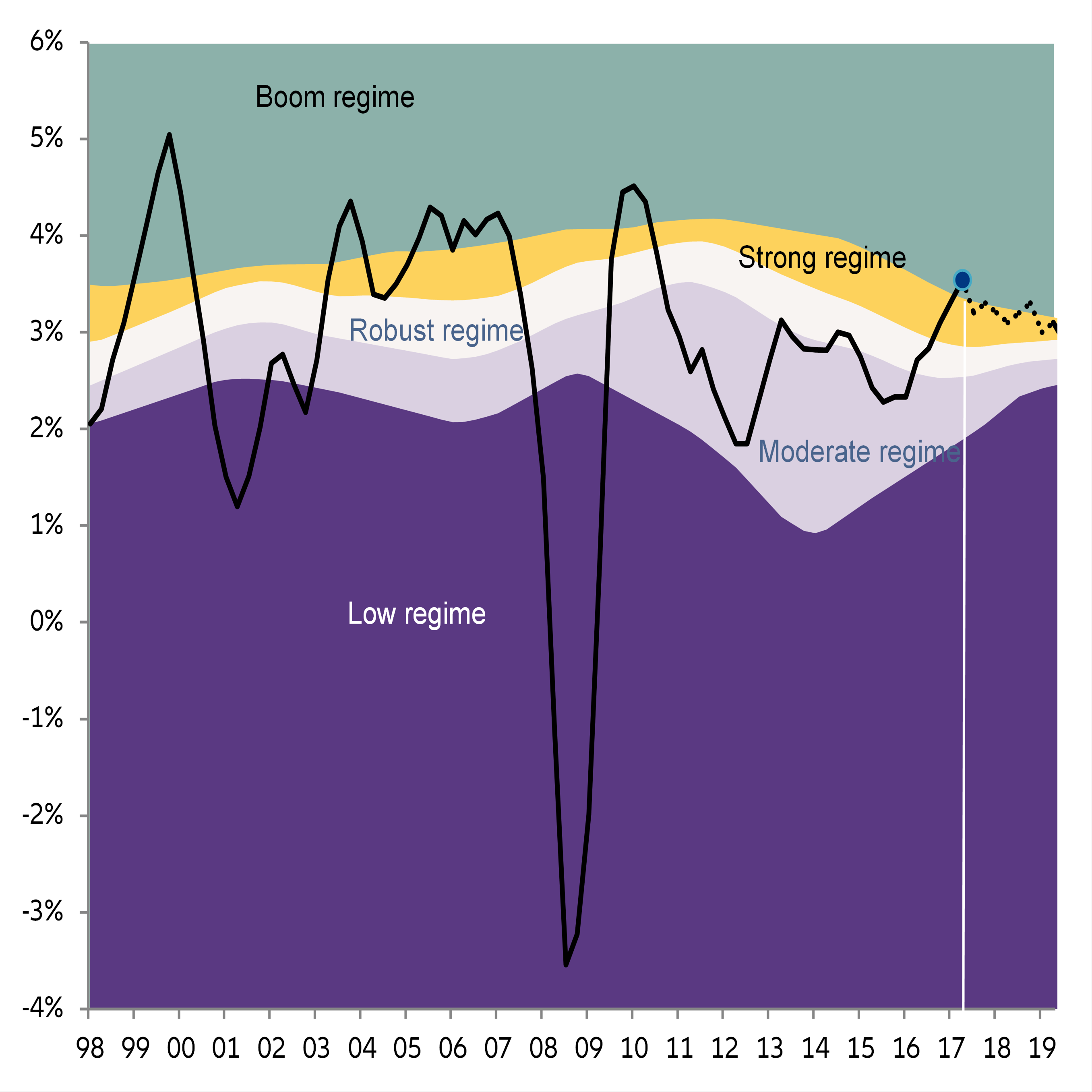

This is the first and most important characteristic of the current regime of growth. In 2017, World economic growth rose above +3% for the first time since 2011.

The succession of unconventional programs of monetary policies, consisting of aggressively injecting liquidity into the real economy, eventually managed to boost global demand, which in turn triggered the rebound of global trade observed in 2017.

In 2018, the largest economies still have room to grow at a fast pace, based on their position in the economic cycle, but room for further acceleration are rather limited.

We believe that the US is at a late stage of its business cycle and has one year of strong growth before cooling.

The US economy has been expanding for 32 consecutive quarters, which is longer than the average length of past periods (31 quarters).

In 2018, we expect economic growth to continue to rise above trend supported by supportive fiscal policy as tax relief could add +0.5pp of GDP.

As fiscal stimulus impacts fade away, and monetary policy tightens, we expect growth to lose some steam from 2019 onwards. Economic growth would rise by +2.6% in 2018 and 2.2% YoY in 2019 compared with 2.3% YoY in 2017.

The Eurozone is also entering a late-cycle phase, although we believe that growth could rise above trend another two years.

Private sector sentiment gauges are at all-time highs, indicating a strong

cyclical momentum supported by fast-paced growth in all key economies.

The ECB is set to terminate asset purchases in October 2018, keep assets level unchanged thereafter, and deliver first rate hike in Q2 2019. Against this background, we expect economic growth to rise to +2.2% in 2018 compared with 2.5% YoY in 2017.

For the Euro zone, distance to the peak of the economic cycle is larger compared with the US but this peak is in sight and decelerating forces are already at work.

In China, growth has already peaked. Tighter credit conditions are set to hinder investment growth and debt intensive activities.

The rest of emerging markets have more room to see higher growth as they just start reap the benefits of the recent recovery in global trade and particularly accommodative credit conditions.

All in all, the world economy is expected to grow by 3.2% YoY in 2018, the same as in 2017, with a probable deceleration at 3.1% YoY in 2019.

The identification of world growth regimes with moving quintiles shows that we are already in an overheating area, suggesting that room for further acceleration is rather limited at a global level.

The “supply” side of the global economic cycle

Global growth will remain elevated in the short run, especially because the central banks in advanced economies would tighten their policies very gradually on the back of a slow pace of inflation.

While growth is accelerating, inflation acceleration remains remarkably soft for now.

We believe this phenomenon is due to supply-side adjustments. One is the US’ emergence as leading energy supplier, as it creates downward pressures on energy prices globally.

Another is an accelerating diffusion of new technology, especially thanks to the exponential development of the Internet, which reduces input and transaction costs.

A third is the wave of competitive tax reforms that is happening in advanced economies, the US being the best and most recent example. And finally, there is qualitative growth in China, which is slowly converging toward a new model of growth that is less dependent on commodity and energy consumption.

This conjunction of supply shocks is the other argument explaining why there is a strong common component in world economic growth, as typically, supply shocks boost growth and depress prices over the long-term.

The dark side of global economic cycle

Structural factors such as supply-side policies or positive transmission of a technology-driven impact explain why the band of fluctuations in world growth has begun to stabilize as a whole, but does not really clarify why we are in the upper part of this band, close to the overheating range.

In this regard, short-term factors temporarily impacting demand are more important.

To better analyze and synthetize these factors, we have built a world monetary and financial condition index, which mirrors the degree of ease with which economic players in world economies can access credit to pursue growth.

In this context, higher interest rates, declining equity prices and an appreciation of the currency all represent a tightening of credit conditions (and inversely for an easing).

Chart 1 World GDP growth and growth regime

-(2).jpeg)