- All eyes on the reinvestment policy: Monthly net purchases under the ECB’s QE program are expected to end come January. The pledge to reinvest maturing bonds will help cushion the impact on financial conditions by ensuring that the ECB maintains a hefty presence in eurozone bond market.

- Implementation bottle necks & tighter financial conditions: Maintaining the current degree of monetary policy accommodation would require reinvesting principal in notably longer-dated sovereign bonds. However mounting implementation constraints – particularly in low-debt core countries – would likely force the ECB to tolerate at least a gradual rise in long-term interest rates.

- Desperately seeking flexibility: To ensure the reinvestment policy’s smooth implementation, we expect the ECB to soon opt for more leeway around its modalities. With the exception of temporary deviations, the capital key constraint should remain sacrosanct, but more flexibility regarding the timing of reinvestments and the composition of purchases should already suffice to do the trick.

- The bottom line for eurozone yields: We expect the rise in long-term rates in 2019 to prove more pronounced in non-core countries due to relatively less favorable stock as well as flow dynamics. Italy stands out as the country with the least favorable prospects judged by demand and supply factors underpinning its sovereign bond markets.

All eyes on the reinvestment policy

The ECB has committed itself to reinvesting the principal from maturing securities purchased under the Asset Purchase Program (APP) since 2014. But with monthly net purchases expected to end after an almost four-year run come January, the reinvestment policy will now take center stage in determining financial conditions in the eurozone until at least September 2019 when we expect the ECB to implement its first timid rate hike.

Reinvestments: A cushion for 2019 and beyond

Whereas net purchases will stop next year, thanks to the reinvestment policy bonds bought under the PSPP program remain on the ECB’s balance sheet for an extended period of time. As maturing principal is reinvested – about €165 billion in total for 2019 – the overall size of the ECB’s Public Sector Purchasing Program (PSPP) portfolio remains constant in euro amounts for as long as the reinvestment policy is fully in place.

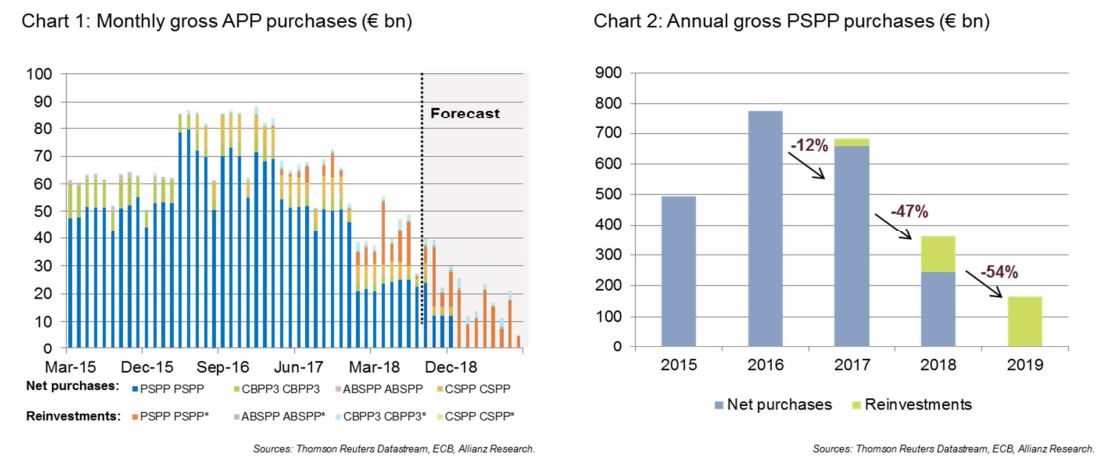

In some months in 2019 PSPP redemptions are expected to exceed the estimated average pace of 2018 net purchases (Chart 1). Nevertheless the overall monthly flows will prove much more volatile compared to current net asset purchases – ranging all the way from an expected € 4 to 21 billion – with the volume of principal reinvested dictated by the securities maturing around that time. For 2019 as a whole PSPP gross purchases will more than halve compared to 2018 (Chart 2).

-(2).jpeg)